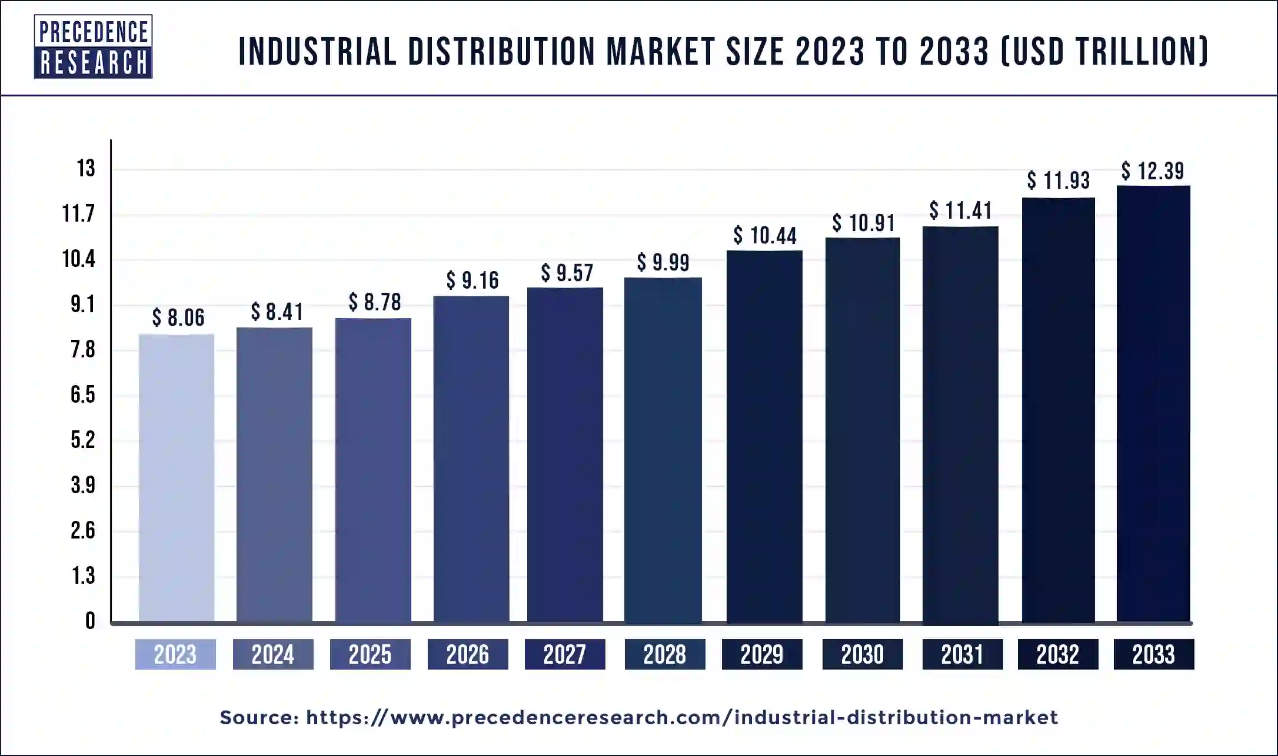

Industrial Distribution Market Size to Surpass USD 12.39 Trillion by 2033

The global industrial distribution market size is calculated at USD 8.41 trillion in 2024 and is projected to surpass around USD 12.39 trillion by 2033, growing at a CAGR of 4.39% from 2024 to 2033.

/EIN News/ -- Ottawa, July 03, 2024 (GLOBE NEWSWIRE) -- The global industrial distribution market size was USD 8.06 trillion in 2023, accounted for USD 8.41 trillion in 2024, and is estimated to be worth around USD 12.39 trillion by 2033, According to Precedence Research. The industrial distribution market is driven by increasing manufacturing units, changing customer preferences, and advanced technology.

The industrial distribution market encompasses the segment of the supply chain focused on distributing industrial products, equipment, and services to various industries such as manufacturing, construction, energy, transportation, and more. Industrial Distribution refers to the transfer of industrial goods from manufacturing to the industrial supply chain, with an Industrial Distributor acting as a sales organization to facilitate this movement. Traditionally, these distributors supplied largely MRO or OEM items to other manufacturers, but the phrase has expanded to cover a wide range of wholesale distributors that work across all trade lines.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2450

According to the National Association of Wholesale Distributors, the ID sector has over 30,000 organizations that produce more than $7.4 trillion in sales each year. These sales groups link manufacturers with retailers, commercial, institutional, and government end customers. An Industrial Distribution degree prepares students for high-level technical sales and leadership positions in a worldwide industry that touches all aspects of life.

Industrial Distribution Market Revenue (USD Billion), By Product, 2021 to 2023

| By Product | 2021 | 2022 | 2023 |

| MRO Supplies | 2,362.2 | 2,459.7 | 2,561.9 |

| Electrical Equipment & Supplies | 2,022.4 | 2,113.3 | 2,209.0 |

| OEM Supplies | 1,119.0 | 1,178.7 | 1,241.9 |

| Hand Tools & Power Tools | 739.5 | 768.2 | 798.3 |

| Bearings | 471.3 | 489.3 | 508.1 |

| Office Equipment & Supplies | 223.9 | 232.7 | 242.0 |

| Others (Includes packaging, industrial machinery, farm, lawn, and garden supplies) | 471.8 | 486.7 | 502.1 |

Industrial Distribution Market Revenue, By Application, 2021 to 2023 (USD Billion)

| By Application | 2021 | 2022 | 2023 |

| eCommerce | 2,408.9 | 2,519.8 | 2,636.5 |

| Offline | 5,001.1 | 5,208.8 | 5,426.8 |

Industrial Distribution Market Key Insights

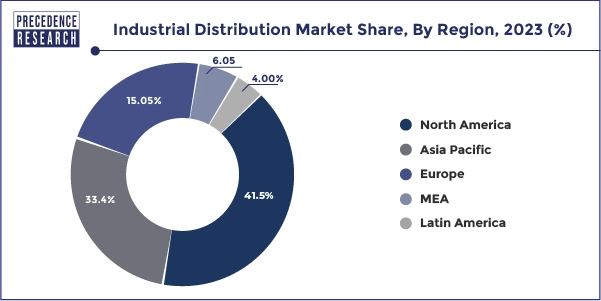

- North America dominated the market with the largest revenue share of 41.5% in 2023

- By product, the MRO supplies segment has held the major revenue share of 31.77% in 2023.

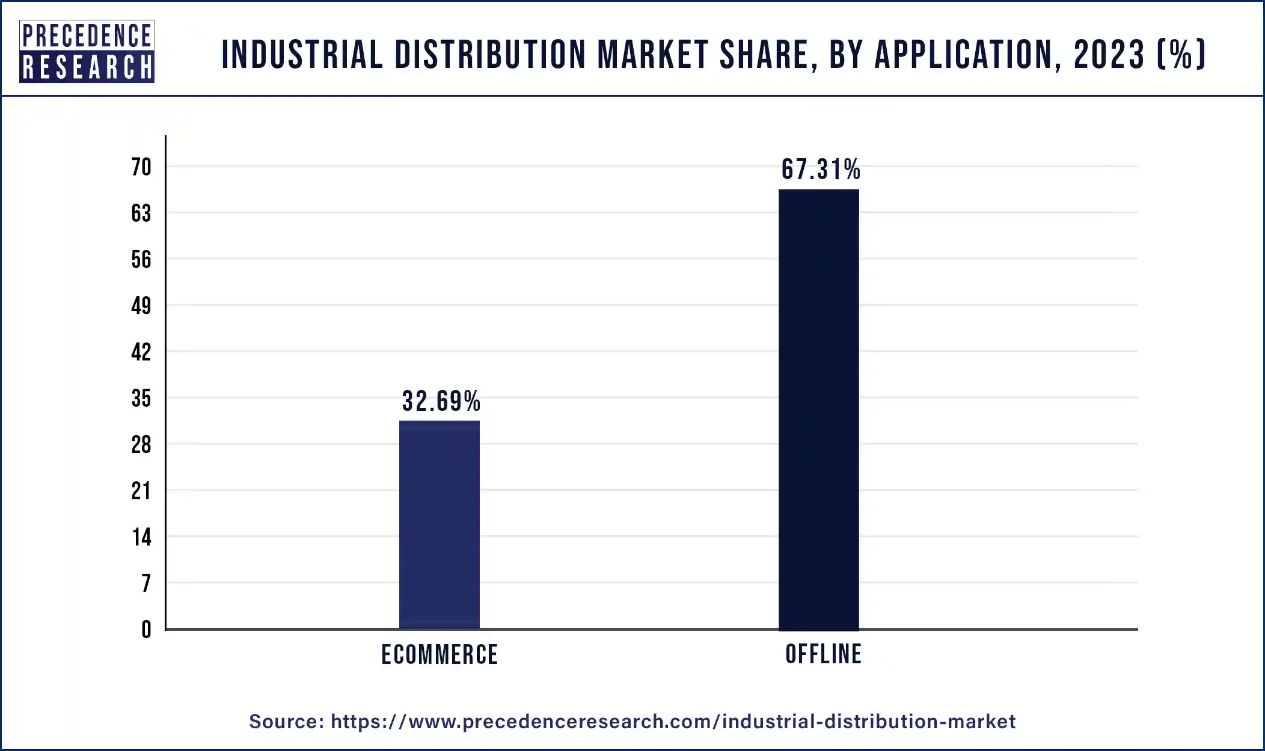

- By applications, the offline segment accounted for the largest revenue share of 67.30% in 2023.

Industrial Distribution Market Projections for Growth by Region Shows:

- The North America industrial distribution market size was valued at USD 3.34 trillion in 2023 and is expected to reach around USD 4.79 trillion by 2033 with a CAGR of 3.65% from 2024 to 2033.

- The Europe industrial distribution market size was estimated at USD 1.21 trillion in 2023 and is projected to hit around USD 1.86 trillion by 2033, growing at a CAGR of 4.41% from 2024 to 2033.

- The Asia Pacific industrial distribution market size was accounted for USD 2.69 trillion in 2023 and is predicted to surpass around USD 4.31 trillion by 2033 with a CAGR of 4.81% from 2024 to 2033.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2450

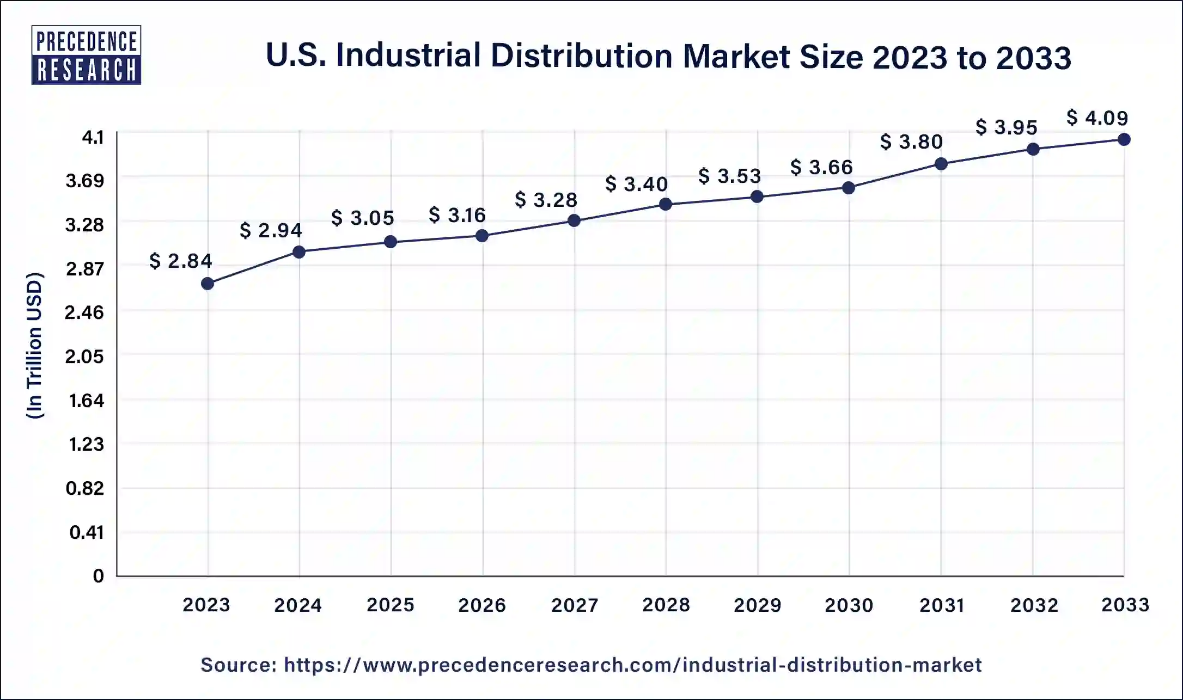

U.S. Industrial Distribution Market Size and Forecast

The U.S. industrial distribution market size reached USD 2.84 trillion in 2023 and is predicted to be worth around USD 4.09 trillion by 2033 with a CAGR of 3.71% from 2024 to 2033.

North America dominated the industrial distribution market in 2023. The introduction of new technologies is expected to cause substantial changes in the industrial distribution business during the next several years. Industry 4.0 technologies such as 3D printing, robots, and blockchain are projected to transform supply chain management by improving automation, customization, and traceability of items. The circular economy concepts, which emphasize product lifecycle management, resource efficiency, and waste reduction, may result in closed-loop supply chains and sustainable business practices.

The transition to predictive maintenance models and servitization is intended to disrupt existing business models by providing value-added services such as maintenance, repairs, and equipment leasing in addition to product sales. These developments indicate a dynamic and transformational future for the industrial distribution business.

Asia Pacific is observed to grow at the fastest rate during the forecast period in the industrial distribution market. Many governments in the region are focusing on infrastructure development, industrial policies, and trade agreements that support industrial growth. These initiatives create a conducive environment for industrial distribution activities. Asia-Pacific has also been adopting advanced technologies in manufacturing and logistics, which has improved efficiency in supply chain management and distribution networks. This technological adoption has further fueled the growth of industrial distribution in the region.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Industrial Distribution Market Coverage

| Report Attribute | Key Statistics |

| Industrial Distribution Market Size in 2033 | USD 12.39 Trillion |

| Industrial Distribution Market Size in 2024 | USD 8.41 Trillion |

| Industrial Distribution Market Growth Rate | CAGR of 4.39% from 2024 to 2033 |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Applications and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Industrial Distribution Market Segments Outlook

Product Outlook

The MRO supplies segment dominated the industrial distribution market in 2023. MRO is critical to the supply chain because it ensures smooth operation, reduces downtime, and increases operational efficiency. It entails regular maintenance and rapid repairs to keep equipment and machinery in peak operating condition. This reduces equipment failures, increases asset longevity, and improves operational efficiency. MRO management reduces downtime by guaranteeing the availability of important tools, spare parts, and services for prompt repairs. It also improves safety and compliance by assuring the availability of safety equipment, performing appropriate inspections, and carrying out repairs.

Inefficient MRO management can result in excess inventory, redundant purchases, and excessive maintenance expenditures. Organizations may save money and streamline operations by employing effective inventory management strategies, streamlining procurement procedures, and utilizing predictive maintenance approaches. MRO tasks sometimes entail working with vendors to purchase replacement parts and maintenance services. Prioritizing and optimizing MRO processes may help firms achieve operational excellence, increase customer satisfaction, and promote overall company success.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/2450

Application Outlook

The offline segment dominated the industrial distribution market in 2023. Retail storefronts, trade exhibitions, direct sales, and distributors are all examples of offline distribution channels that help businesses reach and satisfy their clients. They let businesses demonstrate their products or services in a physical form, so garnering greater attention and interest.

Offline distribution channels may also help clients build trust and loyalty by offering personalized interactions, and after-sales care. Participating in trade exhibitions, events, or awards may help you establish your name and credibility in the business. Offline distribution channels may enhance the consumer experience by providing value-added services, rewards, or entertainment.

Furthermore, physical distribution channels allow businesses to benefit from retail partnerships by gaining access to other established merchants' existing customer bases, distribution networks, or marketing channels. This can help expand reach and exposure, benefiting from the supermarket's brand recognition and trust.

Browse More Insights:

-

Bearing Market Size and Forecast: The global bearing market size was valued at USD 133.99 billion in 2023 and it is predicted to hit over USD 279.83 billion by 2032, poised with a registered CAGR of 8% during the forecast period 2023 to 2032.

-

MRO Distribution Market Size and Forecast: The global MRO distribution market size was estimated at USD 640 billion in 2021 and is expected to reach over USD 839.42 billion by 2032, poised to grow at a CAGR of 2.80% from 2023 to 2032.

-

Blockchain IoT Market Size and Forecast: The global blockchain IoT market is expected to drive growth at a CAGR of 54% during the estimated period and to reach USD 20,938.59 million by 2032 from USD 280 million in 2022.

-

Web 3.0 Market Size and Forecast: The global web 3.0 market size was estimated at USD 2.18 billion in 2023 and is projected to hit around USD 65.78 billion by 2032, expanding at a CAGR of 46% during the forecast period from 2023 to 2032

-

Power Tools Market Size and Forecast: The global power tools market size was valued at USD 31.84 billion in 2023 and is anticipated to reach around USD 63.93 billion by 2033, growing at a CAGR of 7.22% from 2024 to 2033. Rising construction activities in developing regions can boost the market.

-

Battery Power Tools Market Size and Forecast: The global battery power tools market size was valued at USD 25.43 billion in 2023 and is anticipated to reach around USD 49.70 billion by 2033, growing at a CAGR of 6.93% from 2024 to 2033.

-

IT Services Outsourcing Market Size and Forecast: The global IT services outsourcing market size was estimated at USD 525 billion in 2022 and it is expected to hit around USD 1,149.24 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 8.2% during the forecast period 2023 to 2032.

-

Enterprise Mobility Market Size and Forecast: The global enterprise mobility market size was estimated at USD 24.89 billion in 2022 and is expected to hit around USD 194.88 billion by 2032 with a registered CAGR of 22.9% during the forecast period 2023 to 2032.

-

Artificial Intelligence (AI) Market Size and Forecast: The global artificial intelligence (AI) market size was valued at USD 454.12 billion in 2022 and is expected to hit around USD 2,575.16 billion by 2032, progressing with a compound annual growth rate (CAGR) of 19% from 2023 to 2032.

- Blockchain Technology Market Size and Forecast: The global blockchain technology market size was estimated at USD 4.8 billion in 2022 and is extending to around USD 2,334.46 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 85.7% during the forecast period 2023 to 2032.

Industrial Distribution Market Dynamics

Drivers

Cost and Speed

The distribution system has both downsides and benefits for consumer costs. Locals face additional costs when transferring items to an industrial distribution center and conveying them to a retail shop. However, for manufacturers who serve wide geographic areas, it saves money over Direct Store Delivery (DSD) since it allows big volumes of goods to move at a lower cost than moving a limited number of things as they sell.

Staff and Administrative Training

Because of uniformity, the industrial distribution system provides advantages when training workers and administrators to manage and monitor centers. In huge warehouses, equipment is moved over conveyor belts and stored using storage systems. Staff and managers have the abilities and knowledge to migrate to a network of centers without requiring extensive training, allowing them to continue working in new distribution locations.

Restraint: Lack of data

Leaders are 72% more likely to incorporate business analytics into the ERP system, resulting in improved decision-making and more accurate demand planning. Data analytics is critical in the industrial distribution market because it increases agility and visibility. Lack of data can result in difficult demand planning, inefficient inventory management, lengthy decision-making processes, and fragmented data influx. In omnichannel e-commerce, distributors have issues with real-time communication among departments and managing business resources and data. A consolidated data source is critical for efficiently channeling workflow and managing business resources.

Opportunity: Digital transformation and automation

The industrial distribution business is undergoing a substantial move toward digital transformation and automation, driven by the desire to improve inventory management and operating efficiencies. Multi-echelon inventory optimization and machine learning are being used to optimize planning processes, synchronize stocking strategies, and better control inventory levels. This results in higher fill rates, lower costs, and better inventory mix control, particularly during economic swings such as inflation. These tools also improve visibility and communication, allowing planners to establish the best inventory levels based on service-level objectives for each item at each location. This led to a more efficient supply chain and a better customer experience, owing to increased service quality and product availability.

Digital transformation and automation are more than simply technology updates. They represent a fundamental shift in inventory management and customer service, assisting businesses in managing market issues and remaining competitive in a rapidly changing industrial distribution market environment.

Industrial Distribution Market Leaders

- WESCO International (Industrial)

- Airgas, Air Liquide, US

- Würth Industry (USA)

- Border States (Industrial)

- Kaman Distribution Group

- Motion Industries

- Rexel USA, Inc.

- Fastenal Company

- Wolseley Industrial Group

- Sonepar USA (Industrial)

- DXP Enterprises, Inc.

- Applied Industrial Technologies

- Descours et Cabaud

- W.W. Grainger

- F.W. Webb

- Edgen Murray

- MRC Global

- HD Supply

- Winsupply Inc.

- MSC Industrial Supply

Recent Developments

- In June 2024, Cushman & Wakefield assisted Dalfen Industrial with the sale and recapitalization of a 253,055-square-foot industrial property in Atlanta and Phoenix. The portfolio, held by Dalfen Industrial's Value-Add Fund IV, was recapitalized in a joint venture with RGA ReCap Inc. on behalf of Reinsurance Group of America Inc.

- In June 2024, Portland Bolt & Manufacturing Co. purchased Southern Anchor Bolt Co.'s South Carolina manufacturing and galvanizing facilities with the goal of expanding its U.S. manufacturing presence into the East while retaining industry-leading delivery times, service, and reliability. The United firm will provide a larger assortment of made-to-order anchor bolts, rods, studs, and other items, with 100% of clients in the United States receiving their orders within two business days.

- In March 2024, the Wall Street Journal reported that Amazon plans to expand its North American storage and distribution capabilities. Amazon's growth is part of its aim to compete with both online and physical competitors, with the new projects allegedly adding 16 million square feet to its footprint.

Industrial Distribution Market Segments

By Product

- MRO Supplies

- Electrical Equipment and Supplies

- OEM Supplies

- Hand Tools and Power Tools

- Bearings

- Office Equipment and Supplies

- Others

By Applications

- eCommerce

- Offline

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2450

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us:

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.