Molecular Diagnostic Market Size to Record USD 542.97 Million By 2034 | Statifacts

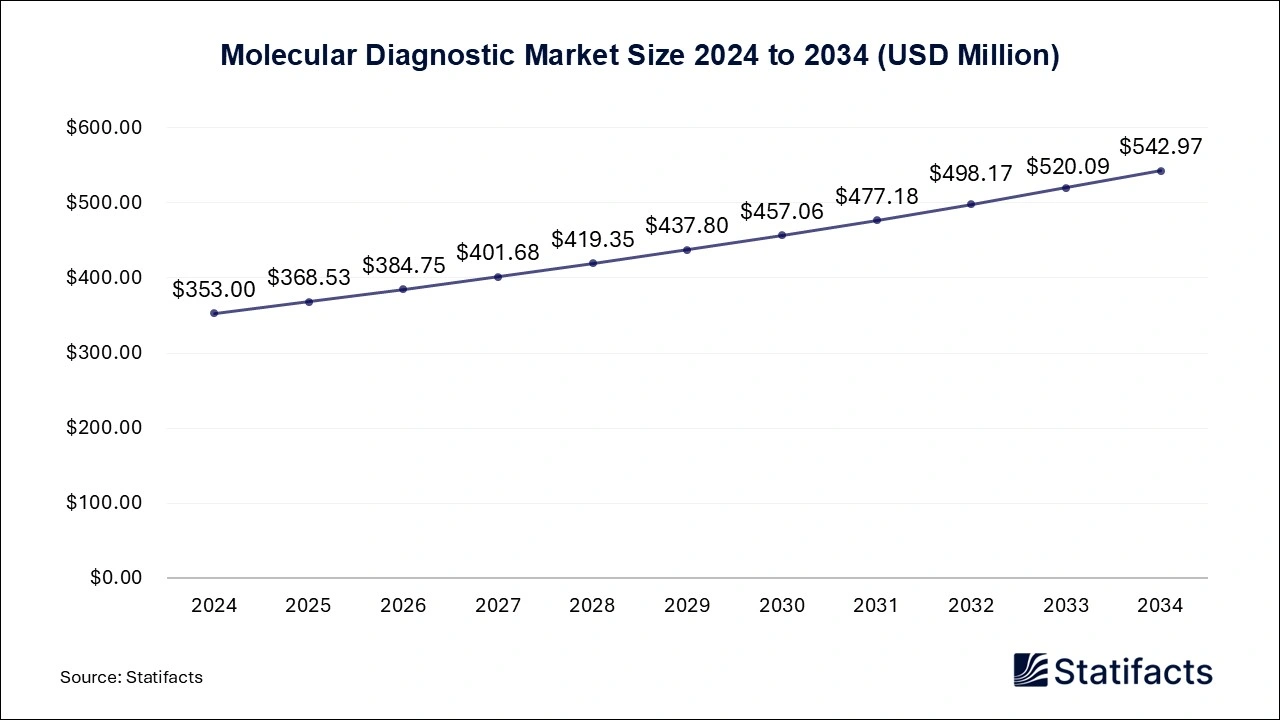

The global molecular diagnostic market size is projected to increase from USD 368.53 million in 2025 and is estimated to be worth around USD 542.97 million by 2034, growing at a CAGR of 4.4 % from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

/EIN News/ -- Ottawa, April 21, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global molecular diagnostic market size was valued at USD 353 million in 2024 and is expected to attain USD 542.97 million by 2034, expanding at a CAGR of 4.4% during the forecast period from 2025 to 2034. The molecular diagnostic market growth is driven by an increase in investment from government and private organizations for the development of many diagnostic service centers, advanced technologies in the healthcare sector, increasing awareness about early diagnosis, and the rising prevalence of infectious diseases like COVID-19, HIV, influenza, pneumonia, and hepatitis.

Request a Sample Databook to Explore our Insights@ https://www.statifacts.com/stats/databook-download/7761

Market Overview

Molecular diagnostics, also known as molecular pathology, involves taking DNA or RNA, the different genetic codes found in our cells, and analyzing the sequences for red flags that can pinpoint the potential emergence of a specific disease. In recent years, this field has expanded rapidly. The molecular diagnostic techniques that help to detect the presence of a pathogen in its early stage of infection are ELISA, Recombinant DNA technology, and Polymerase Chain Reaction.

The molecular diagnostic market growth is accelerated due to it being the branch of clinical pathology or laboratory medicine that uses the techniques of molecular biology to monitor the effectiveness of therapies, select treatments, predict disease course, and diagnose disease. Molecular diagnostics help medical professionals evaluate disease genetic predisposition and allow them to create and implement precise diagnosis techniques and personalize treatment strategies.

As compared to traditional diagnostic methods like ELISA, inhibition tests, hemagglutination, and microbial culture, an advanced microbial diagnostic method provides an enhanced choice for the diagnosis of infectious diseases. Next-generation sequencing technology helps medical professionals better understand their patients’ tumors, discover actionable biomarkers, and make the proper clinical decisions for their patients.

- In November 2023, Roche launched the next-generation qPCR system to advance clinical needs in molecular diagnostics and address public health challenges was launched by Roche.

Molecular Diagnostic Market Key Highlights

- North America dominated the global market with the largest market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the reagents and kits segment is estimated to hold the highest market in 2024.

- By product, the instruments segment is expected to expand at the fastest CAGR over the projected period 2025 to 2034.

- By technology, the polymerase chain reaction (PCR) segment contributed the highest market share in 2024

- By technology, the in situ hybridization (ISH) segment is expected to expand at the fastest CAGR over the projected period.

- By application, the infectious disease diagnostics segment has held the largest market share in 2024.

- By application, the oncology testing segment is observed to grow at a notable rate during the forecast period.

- By end-user, the hospitals and clinics segment accounted the highest market share in 2024.

- By end-user, the diagnostic laboratories segment is anticipated to grow at the fastest rate in the market from 2025 to 2034.

Major Key Trends in the Molecular Diagnostic Market:

- Increasing incidences of infectious diseases: By offering more powerful tools for more accurate and earlier detection of infectious diseases, molecular diagnostics show a true transformation whose positive clinical impact is continuously demonstrated for many infections with benefits including more accurate use of pathogen targets.

- Rising number of R&D initiatives: Innovation and technology are two essential catalysts in diagnostic product development. R&D involves creative work begun on a systematic basis to develop knowledge that can be used to generate new technologies and innovations.

-

Rising senior population: Diagnostic tests are important for senior citizens due to they play an important role in the health and well-being of seniors. Rapid diagnostics produce fast results, enabling timely medical interventions if essential.

Order the Premium Databook Today at the Discounted Rate of $1550! https://www.statifacts.com/order-databook/7761

Limitations & Challenges in the Molecular Diagnostic Market:

- High cost of disease diagnostics: Unnecessary diagnostic tests can generate unnecessary equipment, labor, and reagent costs, which can lead to high healthcare costs. Diagnostic tests can be expensive due to kits tied to use only on instruments.

- Lack of regulatory framework: Lack of regulatory framework disadvantages include leading to inefficiencies and can be burdensome, hindering competition & innovation, discouraging potential new market entrants, and creating barriers to entry.

-

Infrastructure limitations: Infrastructure limitations may include insufficient technical support, inadequate internet bandwidth, and outdated hardware, which can stifle the effective use of technology.

Development of Molecular Diagnostic Platforms: Market’s Largest Potential

The field of molecular diagnosis significantly transformed, driven by technological advancements and enhanced human genetics understanding. Advancements in molecular diagnostics include Polymerase Chain Reaction (PCR) which needs a small amount of genetic material making it easier to detect the presence of pathogens like bacteria and viruses, Next-generation sequencing enables rapid DNA and RNA sequencing which provides information about genetic variation and mutations, and liquid biopsies include blood sampling or other body fluids to detect genetic material or cancer cells.

- In January 2025, the CRISPR gene editing and diagnostic laboratory was launched by Bengaluru-based biotechnology startup CrisprBits in Bengaluru.

- CrisprBits inaugurates CRISPR gene editing and diagnostics laboratory in Bengaluru – Express Healthcare

Regional Analysis:

What Expect from Asian Countries till 2034?

Asia Pacific is projected to host the fastest-growing market in the coming years. The increasing funding for research and development (R&D) in molecular diagnostics, government initiatives, innovations in molecular diagnostics, and the rising prevalence of cancer and infectious diseases are driving the growth of the molecular diagnostic market in the Asia Pacific region.

Top Asian Countries for Molecular Diagnostics

India: In India, there are high-quality molecular diagnostics lab equipment machines with the best prices. India has also developed innovative technologies, such as AI-based molecular diagnostics tools and digital X-rays.

- Japan: The growing senior population in Japan and the integration of advanced technologies like real-time PCR and next-generation sequencing help the growth of the molecular diagnostic market in Japan.

- In August 2024, Hitachi and Gencurix expanded their cancer molecular diagnostics. Hitachi High-Tech Corporation, a Japanese firm, collaborated with Korea-based Gencurix, Inc.

North America Held the Dominant Position: Technological Advancement to Support Growth

North America held a significant share of the molecular diagnostic market in 2024. Rising healthcare spending, advanced technologies in molecular diagnostics, advanced technologies in molecular diagnostics, and the rising prevalence of communicable and non-communicable disorders are driving the growth of the market.

Major Factors for the Market’s Expansion in North America

- In December 2024, a new molecular diagnostic test was launched by Labcorp for patients suspected of infection with the H5N1 virus.

- In May 2022, the U.S. launched its new, fully automated, high-throughput infectious disease molecular diagnostics platform, announced by a leading global medical technology company, BD (Becton, Dickinson, and Company).

Molecular Diagnostic Market Scope

| Report Attribute | Key Statistics |

| Market Size in 2025 | USD 368.53 Million |

| Market Size by 2034 | USD 542.97 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

The reagents and kits segment underwent notable growth in the molecular diagnostic market during 2024. The diagnostic reagents are used for testing many body functions like those in the liver and kidneys. The reagents test for biochemical markers that may indicate abnormal or normal functions.

The instruments segment will gain a significant share of the market over the studied period of 2025 to 2034. The instruments involved in molecular diagnostic labs generally include clinical chemistry analyzers, hematology analyzers, blotting systems, laminar airflow, water baths, pH meters, and DNA sequencers.

Technology Insights

The polymerase chain reaction (PCR) segment captured a significant portion of the molecular diagnostic market in 2024. The PCR technique is used in molecular biology, which helps researchers clone and sequence genes for mutation detection. PCR testing benefits for infectious diseases include reducing healthcare costs, reducing unnecessary testing, and avoiding unnecessary antibiotics.

The in situ hybridization (ISH) segment is projected to expand rapidly in the market in the coming years. In situ hybridization (ISH) has benefits in that its reliability and sensitivity can be predicted from the nucleic acid sequence on which probes are designed. It detects total genome ploidy changes.

Application Insights

The infectious disease diagnostics segment maintained a leading position in the molecular diagnostic market in 2024. Molecular diagnostics offer more powerful tools for more accurate and earlier infectious diseases. Its benefits include more precise use of pathogen target therapies, decreased unnecessary antibiotic use, reduced length of emergency department and hospital stays, and reduced total healthcare costs.

The oncology testing segment is set to experience the fastest rate of market growth from 2025 to 2034. There are many uses of molecular diagnostics in clinical oncology. Mutation analysis is now routinely used for hereditary cancer syndrome diagnosis. They can help to differentiate cancer from benign tumors and can also help identify the tissue type in which cancer originated. In September 2024, QIAcuity digital PCR platforms for clinical testing in oncology were launched by QIAGEN.

End-user Insights

The hospitals and clinics segment held a sizeable share of the molecular diagnostics market. Hospitals and clinics are one of the biggest users of various medical tests for detecting diseases and following up on recovery. Hospitals routinely conduct a wide variety of diagnostic tests to ensure proper treatment management and prevention of the spread of infectious diseases. Hospitals still provide the bulk of healthcare treatment in most countries, leading to them leading this segment.

The diagnostic laboratories segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Diagnostic laboratories are coming up rapidly in emerging economies, supplementing hospitals and clinics by helping perform molecular diagnostic tests. These labs are usually equipped with special infrastructure and state-of-the-art diagnostics protocols, allowing for the handling of testing accurately and efficiently. The continuous advancements in molecular diagnostic technologies have expanded the capabilities of diagnostic laboratories, enabling them to provide more comprehensive and precise testing services.

Browse More Research Reports:

- The U.S. oncology molecular diagnostic market size accounted for USD 792 million in 2024 and is expected to exceed around USD 2,527 million by 2034, growing at a CAGR of 12.3% from 2025 to 2034.

- The global point-of-care molecular diagnostics market size accounted for USD 8,670 million in 2024 and is predicted to touch around USD 12,710 million by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

- The global oncology companion diagnostic market size surpassed USD 5,204 million in 2024 and is predicted to reach around USD 12,095 million by 2034, registering a CAGR of 8.8% from 2025 to 2034.

- The global hospital acquired infections diagnostics market size was estimated at USD 4,310 million in 2024 and is projected to be worth around USD 5,030 million by 2034, growing at a CAGR of 1.56% from 2025 to 2034.

- The global next-generation in vitro diagnostics market size is calculated at USD 96 billion in 2024 and is predicted to reach around USD 163.98 billion by 2034, expanding at a CAGR of 5.5% from 2025 to 2034.

- The U.S. artificial intelligence in diagnostics market size is calculated at USD 655 million in 2024 and is predicted to attain around USD 4,298.47 million by 2034, expanding at a CAGR of 20.7% from 2025 to 2034.

- The U.S. tuberculosis diagnostics market size accounted for USD 594.53 million in 2024 and is expected to exceed around USD 1,025.21 million by 2034, growing at a CAGR of 5.6% from 2024 to 2034.

- The U.S. in vitro diagnostics market size accounted for USD 41,440 million in 2024 and is predicted to touch around USD 72,140 million by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

Order the Premium Databook Today at the Discounted Rate of $1550! https://www.statifacts.com/order-databook/7761

Recent Breakthroughs in the Global Molecular Diagnostic Market:

- In January 2025, the first oncology liquid biopsy products for research, a pan-cancer somatic mutation profiling panel called Northstar Select, was launched by Billion To One.

- In August 2024, the launch of two innovative diagnostic laboratories in Telangana were launched by Metropolis Healthcare Limited.

Segments Covered in the Report

By Product

- Reagents and Kits

- Instruments

- Service and Software

By Technology

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INNAT)

- DNA Sequencing and Next-Generation Sequencing (NGS)

- In Situ Hybridization (ISH)

- DNA Microarrays

- Others

By Application

- Infectious Disease Diagnostics

- Oncology Testing

- Genetic Testing

- Others

By End User

- Diagnostic Laboratories

- Hospitals and Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release