Medical Metal Tubing Market Size to Hit USD 14.22 billion by 2032, With CAGR of 6.7%

The medical tubing market size report covered Nordson Corporation, Saint-Gobain, Freudenberg Medical, & Other key players.

NY, UNITED STATES, April 15, 2025 /EINPresswire.com/ -- The global medical tubing market size was valued at USD 8.52 billion in 2024. It is expected to expand from USD 9.04 billion in 2025 to USD 14.22 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.7% over the forecast period 2025-2032. North America led the medical tubing market, holding a 45.65% market share in 2023.In the healthcare sector, medical tubing plays a vital role in meeting industry standards for a wide range of pharmaceutical and medical applications. It is commonly used with surgical tubing, urological and drainage catheters, respiratory and anesthesiology equipment, peristaltic pumps, IV systems, and biopharmaceutical laboratory instruments.

➤ List of Key Players Profiled in the Medical Tubing Market Report:

• Nordson Corporation (U.S.)

• Saint-Gobain (France)

• Freudenberg Medical (U.S.)

• The Lubrizol Corporation (U.S.)

• TE Connectivity (Switzerland)

• Elkem ASA (Norway)

• RAUMEDIC AG (U.S.)

• Teknor Apex (U.S.)

• Spectrum Plastics Group (Georgia)

➤ Request Free Sample Research Report (PDF):

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/medical-tubing-market-109888

➤ Segmentation:

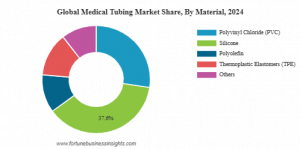

By material, the market is segmented into polyvinyl chloride (PVC), silicone, polyolefin, thermoplastic elastomers (TPE), and others. In 2024, the silicone segment held the largest market share, driven by its superior biocompatibility, chemical resistance, and thermal stability, making it ideal for fluid transfer, peristaltic pumps, infusion systems, catheters, and pharmaceutical processing. According to the IQS directory (May 2024), silicone withstands temperatures from -130°F to 600°F and resists UV and ozone exposure. Meanwhile, the thermoplastic elastomers (TPE) segment is expected to register the fastest growth, thanks to its durability against fluids, flexibility in molding complex components, and eco-friendly recyclability. These advantages are boosting its use in medical tubing and are anticipated to drive segment growth over the forecast period.

By application, the market is divided into cardiovascular, respiratory, urological, and others. In 2023, the cardiovascular segment dominated the market, driven by the increasing global prevalence of heart diseases. Cardiac catheterization, which relies on medical tubing for diagnosis and treatment, is seeing growing use. According to the Journal of the American College of Cardiology (August 2021), cardiovascular risks in the U.S. are expected to rise significantly. The "others" segment is projected to grow at the fastest pace, supported by the rising burden of chronic conditions like cancer, urological, gastrointestinal, and respiratory diseases, boosting demand for medical tubing.

By end-user, the market is segmented into hospitals & ASCs, aged care centers/nursing homes, and others. In 2024, hospitals & ASCs led the market, driven by the high volume of diagnostic, treatment, and emergency procedures requiring medical tubing. The aged care centers/nursing homes segment is expected to grow steadily, supported by increasing use of bulk disposable tubing in these facilities.

➤ Report Scope & Segmentation: Medical Tubing Market

• Market Size Value in 2024: USD 8.52 Billion

• Market Size Value in 2025: USD 9.04 Billion

• Market Size Value in 2032: USD 14.22 Billion

• Growth Rate: CAGR of 6.7% (2025-2032)

• Study Period: 2019-2032

• Base Year: 2024

• Historical Data: 2019-2023

➤ Get a Quote Now:

https://www.fortunebusinessinsights.com/enquiry/get-a-quote/medical-tubing-market-109888

➤ Report Coverage:

The research report offers an in-depth view of the competitive landscape, highlighting key factors like new product launches and market dynamics. It covers the rising prevalence of chronic diseases and major industry developments, including mergers, partnerships, and acquisitions. The report also analyzes market segments across regions, profiles leading companies and their offerings, and examines the impact of COVID-19. Additionally, it provides valuable qualitative and quantitative insights that support overall market growth.

➤ Drivers and Restraints:

The rising incidence of chronic diseases like cancer, cardiovascular, and urological disorders, driven by factors such as aging, obesity, and alcohol consumption, is boosting the demand for medical tubing in diagnosis and treatment. Additionally, the growing preference for minimally invasive surgeries, which rely on advanced tubing for precision and reduced patient risk, is expected to further propel market growth.

Strict regulatory requirements and frequent product recalls are major hurdles for the medical tubing market, causing delays in product launches and increasing compliance costs. Recalls due to safety concerns, like tube malfunctions or labeling issues, can damage manufacturer reputation and hinder market growth.

➤ Regional Insights:

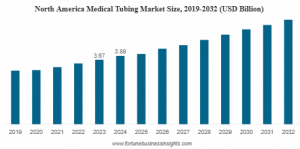

North America led the medical tubing market in 2024 with USD 3.89 billion in revenue, driven by the rising number of cancer cases and the growing use of tubing in treatments like IV therapy and tube feeding. Europe followed, fueled by the high prevalence of heart failure and the need for tubing in ventilators and IV administration. Asia Pacific is projected to grow at the fastest rate due to expanding healthcare infrastructure, spending, and awareness of advanced procedures. Meanwhile, Latin America and the Middle East & Africa are expected to see moderate growth, with rising medical tourism in regions like Dubai and Abu Dhabi boosting demand for medical tubing.

➤ Ask for Customization:

https://www.fortunebusinessinsights.com/enquiry/ask-for-customization/medical-tubing-market-109888

➤ Competitive Landscape:

Other players, including TE Connectivity, Elkem ASA, and W. L. Gore & Associates, Inc., are pursuing strategies like geographic expansion and partnerships to strengthen their presence and capture a larger share of the medical tubing market during the forecast period.

➤ Key Industry Development:

• April 2024: Cobalt Polymers partnered with HnG Medical to distribute its heat shrink tubing for the medical device industry across Asia.

• June 2023: TekniPlex expanded its Costa Rica facility by investing in advanced medical tubing extrusion lines and downstream equipment.

➤ Read Related Insights:

Medical Devices Market Size, Share, Growth & Forecast, 2032

Drug Delivery Systems Market Size, Share, Trends & Analysis, 2032

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release